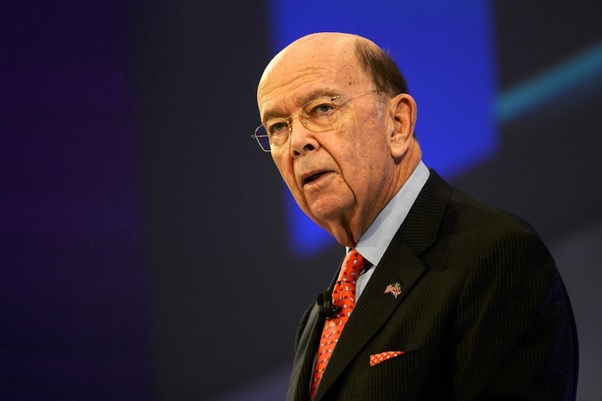

This wasn’t just your everyday press briefing. On September 6, 2025, U.S. Commerce Secretary Howard Lutnick said some things that got people talking about global trade. He was direct, saying India might soon have to apologize and make a deal with the U.S. If not, they could be facing big tariffs.

That’s not something you say lightly, especially when talking about one of the world’s fastest-growing economies.

What’s the Problem?

So, why the tension? There are a couple of main reasons.

First, India’s growing business ties with Russia. While many Western countries have cut back on buying Russian oil because of current world events, India has kept buying it and even increased how much they buy. The U.S. sees this as more than just business; it’s about who India is siding with, and Washington isn’t happy about it.

Second, there’s the BRICS thing. India is a member and has been looking into trade and money systems that don’t use the U.S. dollar. To the U.S., this isn’t just annoying; it’s a challenge to its power in global finance.

Basically, America wants India on its side. India is trying to stay neutral. And now, the U.S. Commerce Secretary is putting pressure on them.

The Apology Thing

The part everyone noticed was India will have to apologize. It’s a strange way to put it. Countries don’t usually apologize when dealing with each other. They talk, they compromise, they make agreements.

But Lutnick’s words weren’t friendly. It was about power. The U.S. thinks it has the upper hand with things like tariffs, access to its markets, and tech help. It’s saying India won’t get all those things unless it changes its ways.

Now, India has to decide whether to give in or stand its ground.

The Tariff Threat

Tariffs aren’t just taxes; they’re tools in trade disagreements. Lutnick mentioned heavy tariffs if India doesn’t change. That’s a big deal because India sells a lot to the U.S. market. Things like clothing, tech, medicine, and steel India’s economy depends on those sales.

Even a small increase in tariffs could affect billions of dollars in trade. It could hurt India’s export businesses, cause job losses, and make investors worry. Plus, the timing is bad because India is already dealing with rising prices at home.

So, yeah, the threat is serious.

The Politics of It All

Let’s be honest. This isn’t just about oil or BRICS. It’s about politics.

The U.S. is getting ready for another election. Taking a tough stance on trade, especially with big economies, is popular with some voters. Standing up to other countries is something that gets attention in American politics.

In India, politics matter too. Prime Minister Narendra Modi’s government has made a name for itself by looking strong on the world stage. Appearing weak or giving in to U.S. demands wouldn’t be good for them.

Both countries are playing to a global audience while also trying to please their own people.

How the Markets See It

Wall Street is worried but interested. Trade fights mean things could change quickly, which can mean opportunities. Investors are paying close attention, especially in areas like energy, tech, and medicine.

In India, the stock market has already reacted to trade news. Any talk of U.S. tariffs makes exporters nervous. Also, the rupee’s value drops whenever there are global risks.

Markets don’t like not knowing what’s going to happen. And right now, there’s a lot of uncertainty.

The Big Picture

Looking at the bigger picture, this isn’t just the U.S. against India. It’s about how global trade is changing.

The U.S. is trying to stay in charge. India is trying to be more independent. BRICS is pushing for other options. Russia and China are also big players in the background. And the world is watching closely as these big countries move and clash.

It’s like a chess game where every move means something. Every threat has hidden meanings.

What It Means for Regular People

Trade wars might sound distant, but they can affect people quickly. Higher tariffs could mean more expensive goods, like clothes and medicine. Businesses that sell overseas might have to lay people off. And people might start feeling the pinch of rising prices again.

For Americans, it could mean fewer products available. If India fights back, some imports could become more expensive. It’s not just about numbers; it’s about real life.

In Conclusion: Trouble Ahead?

Howard Lutnick’s comments were more than just words. They were a message. The U.S. is getting ready to be tougher on India unless things change.

Will India change its plans? Maybe. Maybe not. Will the U.S. actually put tariffs in place? That depends on what happens in private trade talks.

One thing’s for sure: this isn’t the end of the story. It’s the start of a new chapter in U.S.-India relations, one with a lot at stake, strong words, and uncertain results.

For now, the world is waiting and watching.