The collection could have been higher, if there have been improved recovery in arrear demand.

| Photo Credit:

iStockphoto

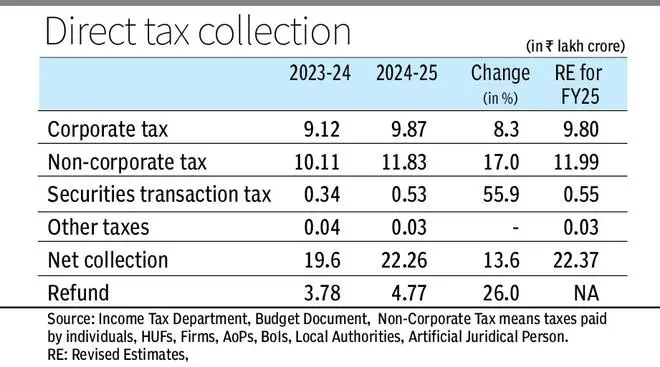

Bear run in the stock market and higher refund caused net direct tax collection to miss the revised estimates (RE) target for fiscal year 2024-25 (FY25) by around ₹10,000 crore. However, collection from corporate tax and non-corporate tax exceeded revised estimates.

Provisional data released by the Income Tax Department showed that net collection rose 13.6 per cent to reach ₹22.26 lakh crore in FY25. RE was ₹22.37 lakh crore. The factor responsible for collection lower than RE was Securities Transaction Tax (STT). As long spell of bear market saw transaction at lower value in February and March and STT is levied ad valorem (percentage of value), this affected collection of STT and it missed the RE. At the same time, refunds were significant higher. Data showed refunds rose to over ₹4.77 lakh crore in FY25 as against ₹3.78 lakh crore of FY24, showing an increase of 26 per cent.

Meanwhile, corporate tax collection exceeded RE. Though industrial production slowed down a bit, still the impact was not considerable. At the same time, over 4,000 listed corporates disclosed a revenue growth of 6.2 per cent, with EBITDA and PAT rising 11 per cent and 12 per cent, respectively, in Q3FY25 compared to the same quarter of the previous year. All these helped collection.

Non-corporate Tax (taxes paid by individuals, HUFs, firms, AoPs, BoIs, local authorities, artificial juridical person) saw much better collection. Though the Central Board of Direct Taxes (CBDT) did not give any reason for the rise, it is believed that incomes of businesses and professionals are expected to see a significant growth. That was reflected in the higher advance tax collections from non-corporate assessees and that helped overall collection to grow.

The collection could have been higher, if there have been improved recovery in arrear demand. Recently, a Parliamentary panel said that more than 2/3rd or around ₹29 lakh crore of total direct tax arrears are difficult to collect. The Panel’s report highlighted total arrears of direct taxes as on February 14 at over ₹43 lakh crore, out of which around ₹29 lakh crore have been categorised as ‘Demand difficult to collect’. In his submission before the Committee, Chairman, CBDT (Central Board of Direct Taxes), said huge arrear demand which is a cause of concern for tax administration.

Published on April 25, 2025