The tightening of credit underwriting standards on unsecured loans amid tight liquidity conditions in Q4, also led to retail loan growth slowdown, experts say.

| Photo Credit:

DHIRAJ SINGH

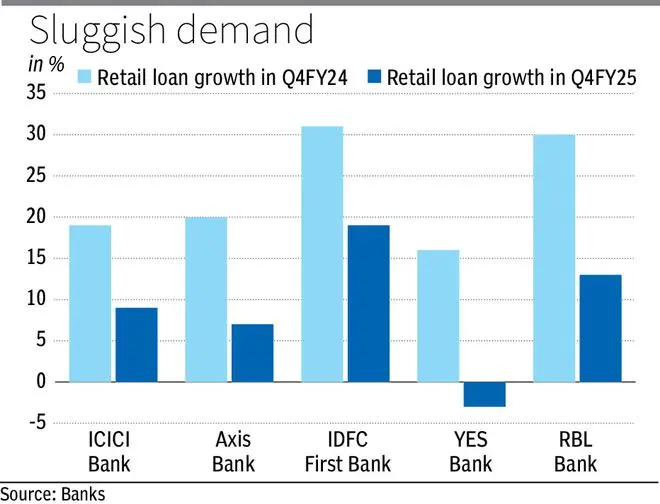

Large and mid-sized banks have registered a steep fall in the pace of retail loan growth in Q4FY25, typically viewed as the busiest financial quarter for business growth, owing to lower demand and pricing issues for home and vehicle loans. The tightening of credit underwriting standards on unsecured loans amid tight liquidity conditions in Q4, also led to retail loan growth slowdown, experts say.

Sandeep Batra, ED at ICICI Bank, says the lender’s loan growth has primarily slowed in the unsecured segment. “Our approach has been more of a risk-calibrated growth. And, of course, during this period, we have seen intense competition in the pricing of mortgages and corporate loans. Given the expectation of imminent rate cuts, we were focused on appropriate spread over our benchmarks during the quarter, and were focused more on sustainable profitability,” he said.

Arjun Chowdhry, group executive—retail lending, NRI, payments and affluent banking at Axis Bank, said the lender has been calibrating different retail asset segments growth. “As we see early signs of improvement on that, we will be opening up the acquisitions in retail assets. Specifically, we had taken some actions to tighten/calibrate the originations in the unsecured book, and we are seeing early positive results on that. On our secured book, we will build it back up as it continues to hold well,” he said, adding that spending on credit cards has decreased over the last year period, and there has been sluggish demand for home loans and vehicle loans, especially passenger car sales.

“It is a combination of factors. There is a bit of macro and little bit on account of banks’ action,” he said.

Growth pangs

Private sector major ICICI Bank’s retail loans grew at a pace of 9 per cent year-on-year (y-o-y) in Q4FY25 to ₹7.17 lakh crore, significantly lower than the 19 per cent growth seen in Q4FY24. Mortgage loans, which constitute the largest portion of the retail loan book, grew 11 per cent in Q4FY25, while vehicle loans and personal loans grew 4 per cent each, credit card loans were up 12 per cent, and loans against shares and other instruments declined 4 per cent on a yearly basis.

Similarly, Axis Bank’s retail loans grew at a rate of 7 per cent in Q4FY25, compared to 20 per cent last year, IDFC First Bank’s retail finance loans grew 19 per cent in Q4FY25, down from 31 per cent in same quarter last year, while RBL Bank’s retail loans grew 13 per cent, less than half of the 30 per cent growth seen last year.

Mid-sized lender Yes Bank, in fact, saw retail loans decline by 3 per cent in Q4FY25, compared to a 16 per cent growth seen in Q4FY24. Lenders with a high credit-deposit ratio also opted to slow the pace of their overall loan growth.

Published on April 27, 2025