The volatility of past couple of weeks has brought to fore the importance of asset allocation. Capital protection and diversification play a paramount part in one’s successful investing journey. And what better way to do it than with a sovereign backed instrument? Here we take a look at Government of India’s Floating Rate Savings Bond (FRSB) and guide if you should go for it.

Interest rate

FRSBs are interest bearing bonds issued by the Government of India, repayable after 7 years. Interest is paid half-yearly on January 1 and July 1 of every year. Since these are floating rate bonds, the interest rate is reset every six months (on January 1 and July 1), at a premium of 35 basis points (bps) to the prevailing rate for NSCs (National Savings Certificates). Currently, the interest rate on NSCs is 7.7 per cent and hence, the applicable rate for FRSBs is 8.05 per cent.

The NSC is also a government-backed instrument that matures after five years. There are a couple of things that fundamentally differentiate the FRSB from the NSC. First, the interest rate on NSC is fixed for the entire tenor of five years unlike the FRSB and therefore, investors can lock-in the rate of return at the time of opening the NSC account. The interest rate for NSCs is reviewed quarterly, based on the average yield on the 5-year government security. Secondly, the interest accrued year after year on the NSC is repaid cumulatively only on maturity.

How you can buy

A cool feature that differentiates FRSBs is that they are available on tap as against dated securities, whose issues follow a fixed schedule. Investors can approach their banks or use the RBI Retail Direct platform to purchase FRSBs. A few banks also take applications on their net banking portals. The minimum investment required is ₹1,000, which also happens to be the face value of a bond and can be increased in multiples of ₹1,000. There is no cap on the maximum amount you can invest.

Taxation & other terms

Interest from FRSBs is taxed as per applicable tax slabs. TDS is applicable. However, one can get an exemption from TDS on submitting Form 15G or 15H. Only resident individuals and HUFs are eligible to invest in FRSBs. There is no bar on age except, in case of minors, guardians can invest on behalf of minors. Nomination and joint holding are permitted. FRSBs are neither transferable nor can be used as collateral for loans.

Premature encashment

Premature encashment is allowed. Investors who are 80 and above can withdraw after a lock-in of four years, those aged between 70 and 80 can withdraw after 5 years and those from 60 to 70 can withdraw after 6 years. Age on the date of premature encashment is relevant and not the age as on the date of investment. In case of joint holding, at least one of the investors should meet the age criteria.

However, a point to be noted is that the redemption amount (principal with interest calculated after deducting penalty) will be paid only on the interest payment date following the date of premature encashment. For instance, if the premature encashment is applied for on August 31, then the redemption proceeds will be credited only on January 1. Penalty is calculated as half of the interest due and payable for the last six months of the holding period. In the example given above, penalty will be 50 per cent of the interest payable for the period July 1 to December 31.

Partial premature encashment is possible, had the investment amount been divided and invested in multiple applications. Meaning, if say ₹1 lakh is invested in two applications of ₹50,000 each, then you can apply for premature encashment of bonds under any one of the applications, while the other continues to maturity.

Our take

The 7-year tenor of the bond is long enough to accommodate multiple interest rate cycles.

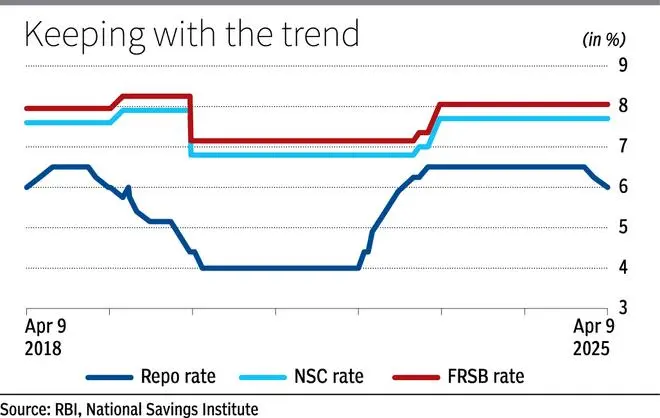

Cycles have become shorter and in the past seven years, we had a rate (repo rate) hike cycle from August 2017 to August 2018 (6 to 6.5 per cent), a period of constant rates until January 2019, a rate downcycle till May 2020 (6.5 to 4 per cent), constant rates until April 2022, a rate hike cycle from May 2022 to February 2023 (4 to 6.5 per cent), constant rates until January 2025 and the ensuing rate downcycle since February (6.5 to 6 per cent so far). Given this observation, it would be safe to assume that the ongoing rate cut cycle may not last an FRSB’s entire tenor of seven years.

The money market is influenced by a lot of variables and is quite difficult to time the rate hike cycles and downcycles. In this context, a key limitation of a term deposit or any product that allows you to lock-in the interest rate for the tenor of the investment is that such products suffer from reinvestment risk – the risk that rates might be lower when you want to reinvest the maturity proceeds. Currently, banks offer higher rates on FDs for tenors exceeding one year and not more than 3 years. Interest rates could be lower when such an FD matures. With FRSB, you can rest easy as the rates get reset every six months, enabling you to enjoy rate upcycles as and when they occur.

The interest rate on FRSB relies on the rate government pays the NSC. An analysis of NSC rates over the last 10 years reveals an average spread of 62 bps over the 5-year G-sec yield, with a range between -35 bps and 163 bps. With a further 35 bps spread over the NSC rate, the FRSB could deliver inflation beating returns, while the capital remains secured by a sovereign guarantee.

Risk-averse investors and senior citizens of course, can consider FRSBs to supplement income from other investments such as NPS annuity, bank FDs, Post Office Monthly Income Scheme and the Senior Citizens Savings Scheme.

Published on April 19, 2025