I’m currently holding one lot of 550-call option on Berger Paints. I bought for ₹4.60 What is the outlook? Shall I hold until expiry? – Akshay Sharma

Berger Paints (₹543.60): The stock has been in a steady uptrend since early 2025. It started to rally after finding support at ₹440. But the chart shows that the stock has been struggling to get past the resistance at ₹550 for the past few sessions. A breakout of this, which is likely to happen, can lift the stock to ₹580 and ₹600 in the near-term.

However, whether this up move can happen before the expiry of April contracts is highly uncertain. And also, remember that futures and options contracts will not be available on Berger Paints from April 25. Given these factors, we suggest you exit the trade at the prevailing premium on Monday open.

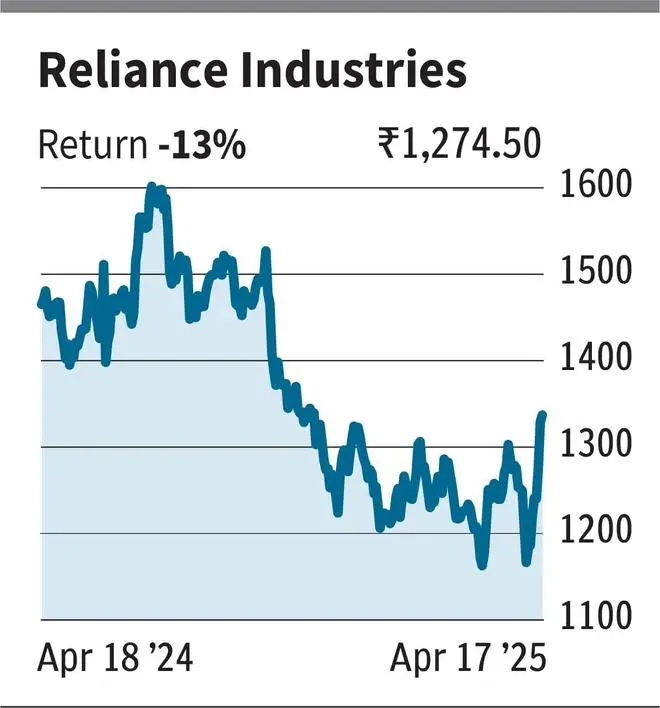

I bought Reliance call option (1400-strike of May expiry) for ₹4. What is the short-term outlook for the stock? – Rahul K

Reliance Industries (₹1,274.50): Over the past two weeks, the stock has seen a sharp rise in price. This upswing looks steady and there is a good chance for the stock to extend the rally.

From the current level, the nearest notable resistance is at ₹1,320. On the back of this, there might be a minor pull back, probably to ₹1,275-1,250. But eventually, the scrip is expected to break out of ₹1,320 and appreciate to ₹1,400 in the near-term.

If the stock touches ₹1,320 in the next two weeks, the premium of 1400-call of May expiry can rise to ₹7.80. A rally to ₹1,400 within a month can lift the option to ₹25 approximately.

As there is chance for a minor dip in stock price after it touches ₹1,320, we suggest exiting your position when the premium hits ₹7.50. Post this, you can consider buying the option (at the going premium) again after the stock breaks out of ₹1,320. In this case, you can look for a target of ₹25.

Send your queries to derivatives@thehindu.co.in

Published on April 19, 2025