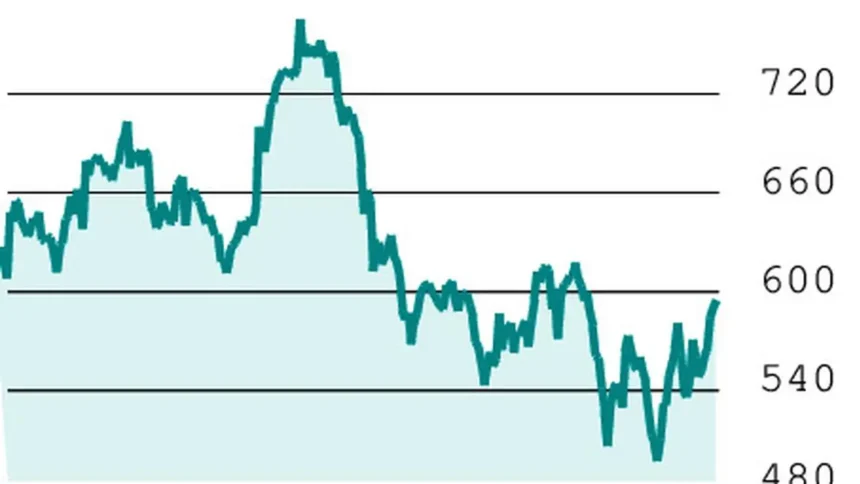

The stock of AU Small Finance Bank (₹586.55) is ruling at a crucial level. The short-term outlook is positive as long as it stays above ₹529.

The stock finds an immediate support at ₹563. Immediate resistance levels are at ₹633 and ₹735. A close above the latter will alter the long-term outlook also positive. We expect the stock to move in a narrow range with a positive bias.

Event: It’s board will meet on April 22 to consider Q4 results.

F&O pointers: AU Small Finance Bank witnessed a rollover of 23 per cent from April to May contracts. Interestingly, AU Small Finance Bank’s April futures is ruling at ₹581.60 against May value of ₹572.85 and June’s ₹566.55. The backwardation indicates rollover of short positions. Option trading (May) hints that the stock could move in the ₹550-600 range.

Strategy: Consider a bull-call spread. The stock will be volatile post results. Traders could consider buying 585-call and simultaneously selling 600-strike call of AU Small Finance Bank (May series). These options closed with a premium of ₹24.95 and ₹19.20 respectively, making the total outgo as ₹5.75/contract.

As the market lot is 1,000 shares, this would cost traders ₹5,750, which would be the maximum loss. Traders would suffer the maximum loss, if AU Bank is stuck at or below ₹585 on expiry. On the other hand, a profit of ₹9.25 or ₹9,250 is possible if AU Bank hits ₹600.

Follow-up: Shares of SAIL moved on expected lines and hit profit target.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading.

Published on April 19, 2025