While some firms deferred wage hikes this year due to pricing pressures and shifting client priorities, hiring in niche and emerging tech domains remains active

| Photo Credit:

VIVEK PRAKASH

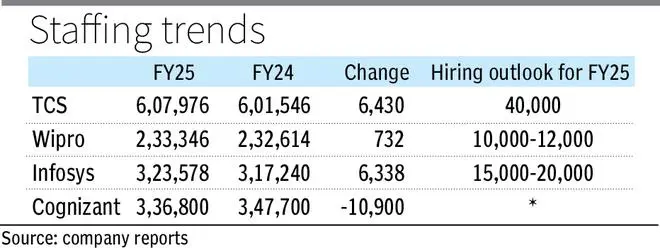

FY25 was marked by subdued hiring activity across major IT companies, with many adopting a cautious approach amid global macroeconomic uncertainties and tightening client budgets. Several top-tier firms slowed down campus recruitment, prioritising internal talent mobility and cost optimisation.

However, the fiscal year also marked a recovery phase for major Indian IT firms, following the headcount contraction in FY24. Industry players remain optimistic about hiring in the IT services industry growing by 7-10 per cent in the first half of 2025, and nearly 4-4.5 lakh new jobs in FY26.

Hiring surge

In FY25, leading IT companies such as Infosys, TCS, and Wipro collectively added 13,500 employees to their workforce, reversing the trend from FY24, when the trio saw a combined reduction of over 55,000 employees.

Sachin Alug, CEO of NLB Services, shared, “Hiring remained measured in Q4, reflecting continued caution in client spending and persistent macroeconomic headwinds. Attrition rates have stabilised across the industry at an average of 13–15 per cent, indicating a more balanced yet evolving talent landscape.”

While some firms deferred wage hikes this year due to pricing pressures and shifting client priorities, hiring in niche and emerging tech domains remains active, both in India and globally. Firms also announced plans to retain a similar fresher hiring outlook in FY26, signalling long-term confidence despite short-term challenges.

Fresher demand

Sunil Nehra, the CEO of IT Staffing at FirstMeridian Business Services, said that investments towards AI/ML, cloud computing, data engineering, and automation have remained steady, signalling long-term confidence in emerging technologies and influencing hiring trends.

“The sentiment on fresher hiring in FY26 remains positive, indicating strong demand for entry-level roles. With India’s young talent showing impressive niche skill sets in emerging technologies, companies are turning towards investing in upskilling programs that bridge the gap between specialised skills and building a robust pipeline of talent for future growth,” Nehra said.

Roles like AI/ML Engineers, Data Scientists, Cloud Architects, DevOps Engineers, and ESG Analysts remain in high demand, often earning an 8-10 per cent premium in compensation. As clients adopt a more measured approach to large-scale transformation and discretionary spending, IT companies are scaling thoughtfully to build future-ready talent.

“With IT hiring, the focus has transformed to creating high-impact and resilient teams who can work in tandem with the demands of the industry. Overall, it is safe to say the sentiment for the quarter has been a cautious yet constructive one,” he added.

(with inputs from bl intern Rohan G Das)

Published on April 18, 2025